USDA FSA-2330 2016-2026 free printable template

Show details

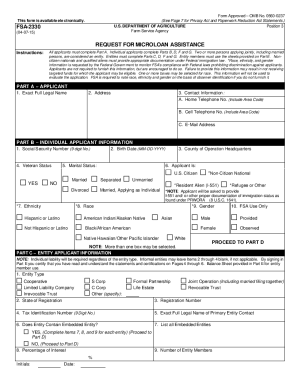

Date Signed MM-DD-YYYY PART H FSA USE ONLY 2. Date Application Complete 1. Date Form FSA-2330 Received 3. Percentage of Interest 9. Number of Entity Members Initials Date FSA-2330 05-05-16 Page 2 of 7 PART D FINANCIAL STATEMENTS FOR INDIVIDUAL OR ENTITY APPLICANT PROJECTED ANNUAL INCOME AND EXPENSES 1. This form is available electronically. FSA-2330 U.S. DEPARTMENT OF AGRICULTURE Farm Service Agency 05-05-16 Form Approved OMB No. 0560-0237 Position 3 REQUEST FOR MICROLOAN ASSISTANCE...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign agriculture fsa 2330 form

Edit your usda fsa 2330 microloan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fsa 2330 fillable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

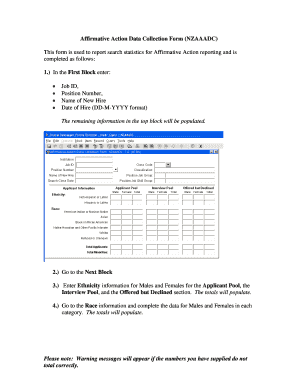

Editing usda form request online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fsa 2330 fill form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

USDA FSA-2330 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out usda form

How to fill out USDA FSA-2330

01

Obtain the USDA FSA-2330 form from the USDA website or local FSA office.

02

Read the instructions provided with the form carefully to understand the requirements and sections.

03

Fill out your personal information in Section A, including your name, address, and contact details.

04

Provide the required details about the farm or operation in Section B, such as operation type and size.

05

Complete Section C by providing the necessary information related to the assistance requested.

06

Attach any required documentation as specified in the instructions.

07

Review all entered information for accuracy and completeness before submitting.

08

Sign and date the form in Section D, certifying that the information is true and correct.

Who needs USDA FSA-2330?

01

Farmers and ranchers seeking financial assistance or support from the USDA.

02

Individuals or entities involved in agriculture who need to report crop or livestock losses.

03

Those applying for conservation programs or other USDA services related to farming.

Fill

usda forms pdf

: Try Risk Free

People Also Ask about fsa forms online

Does USDA loan require tax returns?

USDA requires all applicants to be current on their income tax filings. An applicant with an approved IRS extension for the current tax year may continue to be eligible if they are not delinquent on taxes owed as determined by the IRS.

Can a borrower get cash back on a USDA purchase?

p: Cash from/to Borrower: The borrower can only receive cash back in the amount that represents their own funds that are invested in the transaction. USDA refinance transactions are not “cash” out opportunities for debt reduction, money out for repairs, etc.

How does USDA recapture work?

Calculating recapture amounts. The Agency's subsidy recapture policy requires borrowers to repay some or all of the subsidy received over the life of the loan. When borrowers pay off the principal and interest balance of their loan, subsidy recapture must be calculated and the borrower informed of the recapture amount.

How do I request a payoff from USDA?

With a touch-tone telephone, call 1-800-414-1226, and select option #2 from the Main Menu, and select option #1 from the Payoff Information Menu. Through our Interactive Voice Response system you can request a Statement of Loan Balance be mailed to the homeowner of record.

How can I avoid USDA subsidy recapture?

– If a borrower pays their loan in full and continues to occupy the property, subsidy recapture can be deferred until they move or transfer the property title to someone else.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send usda microloan for eSignature?

When you're ready to share your how to fsa 2330, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit 7001 fill out on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share budget utility allowance from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete usda fsa forms on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your fsa form by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is USDA FSA-2330?

USDA FSA-2330 is a form used by the United States Department of Agriculture's Farm Service Agency to report certain agricultural program data and compliance information.

Who is required to file USDA FSA-2330?

Producers and farmers who participate in specific USDA programs or receive government payments are required to file USDA FSA-2330.

How to fill out USDA FSA-2330?

To fill out USDA FSA-2330, applicants must provide their personal information, report the relevant agricultural data, and ensure all required fields are completed accurately before submitting the form to their local FSA office.

What is the purpose of USDA FSA-2330?

The purpose of USDA FSA-2330 is to collect data for compliance and program administration, ensuring accountability and proper distribution of benefits within agricultural programs.

What information must be reported on USDA FSA-2330?

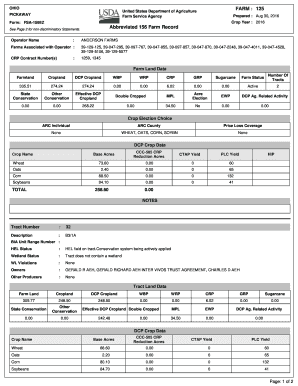

Information that must be reported on USDA FSA-2330 includes producer identification, land use details, crop types grown, and details of any government program participation.

Fill out your USDA FSA-2330 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Usda Fsa is not the form you're looking for?Search for another form here.

Keywords relevant to usda microloan program

Related to usda application form pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.